What’s Happening with Home Prices in Northern Colorado Springs?

Should I Buy a Home Right Now? Experts Say Prices Are Only Going Up

At one point or another, you’ve probably heard someone say, “Yesterday was the best time to buy a home, but the next best time is today.”

That’s because nationally, home values continue to rise. And with mortgage rates still stubbornly high and home prices going up, you may be holding out for prices to fall or trying to time the market for that perfect rate. But here’s the truth: waiting for the right moment could cost you in the long run.

Home Prices Are Still Rising – Just at a More Normal Pace

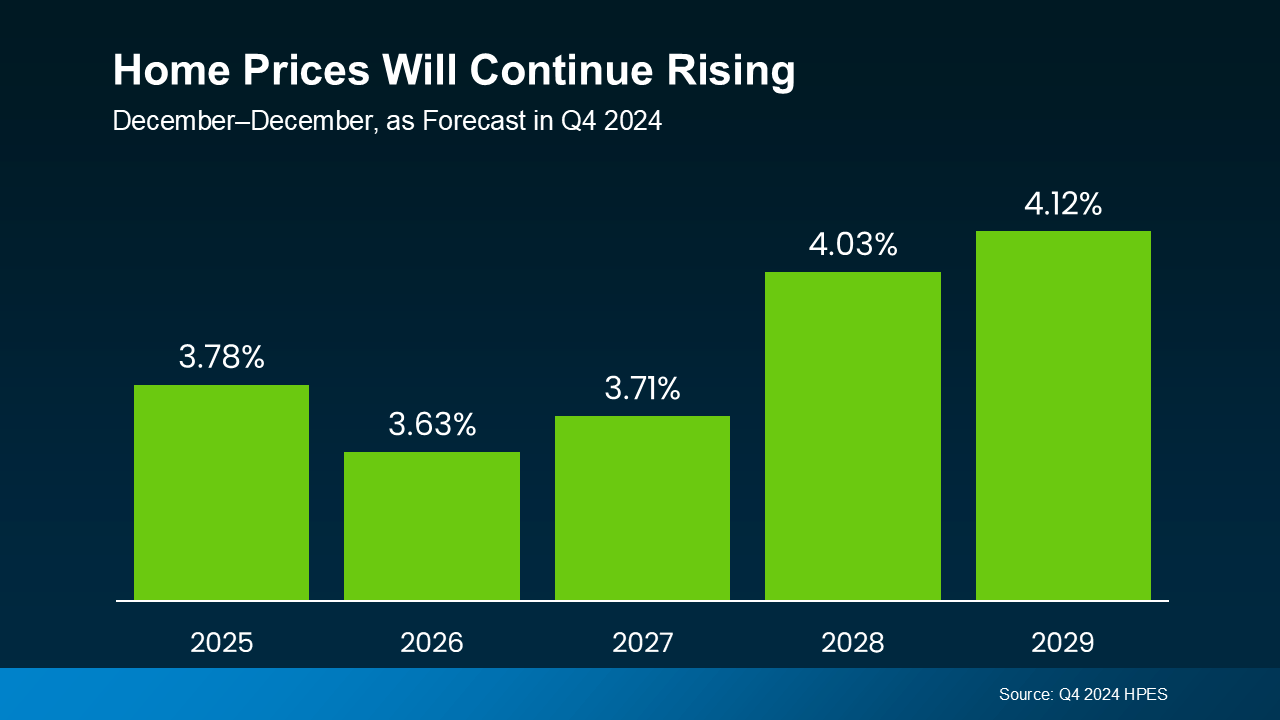

The idea that prices will drop dramatically is wishful thinking in most markets. According to the Home Price Expectations Survey from Fannie Mae, industry analysts are saying prices are projected to keep rising through at least 2029.

While we’re no longer seeing the steep spikes of previous years, experts project a steady and sustainable increase of around 3-4% per year, nationally. And the good news is, this is a much more normal pace – a welcome sign for hopeful buyers (see graph below):

What This Means for You

While it’s tempting to wait it out for prices or mortgage rates to decline before you buy, here’s what you’ll need to consider if you do.

Tomorrow’s home prices will be higher than today’s. The longer you wait, the more that purchase price will go up.

Waiting for the perfect mortgage rate or a price drop may backfire. Even if rates dip slightly, rising home prices could still make waiting more expensive overall.

Buying now means building equity sooner. Home values are rising, which means your investment starts growing as soon as you buy.

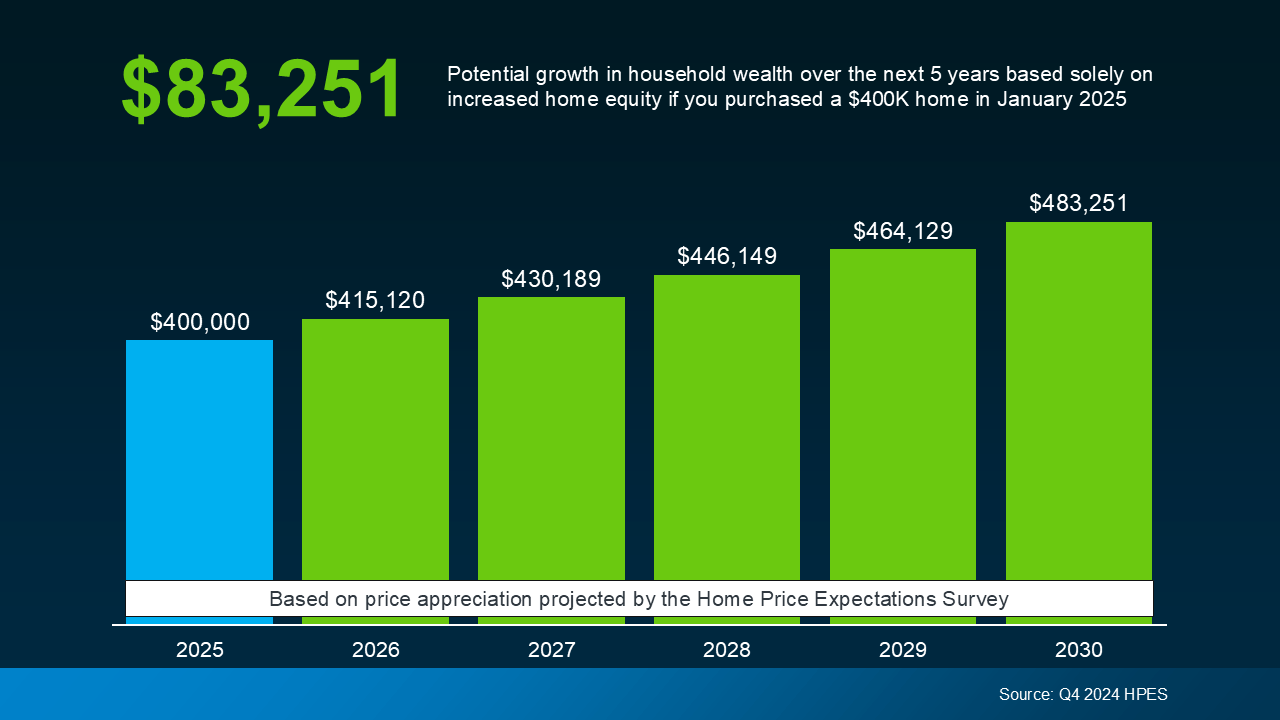

Let’s put real numbers into this equation:

If you purchase a $400,000 home today, based on these price forecasts, it’s expected to go up in value by more than $83,000 over the next five years. That’s some serious money back in your pocket instead of being left on the sidelines (see graph below):

Why Aren’t Prices Dropping? It’s All About Supply and Demand

Even though there are more homes for sale right now than there were at this time last year, or even last month, there still aren’t enough of them on the market for all the buyers who want to purchase them. And that puts continued upward pressure on prices. As Redfin puts it:

"Prices will rise at a pace similar to that of the second half of 2024 because we don’t expect there to be enough new inventory to meet demand."

While every market is different, most areas will continue to see moderate price growth. Some may level off a bit, but a major national drop? Not likely.

Time in the Market Beats Timing the Market

If you’re debating whether to buy now or wait, remember this: real estate rewards those who get in the market, not those who try to time it perfectly.

Yes, today’s housing market has its challenges, but there are ways to make it work —exploring different neighborhoods, considering smaller condos or townhomes, asking your lender about alternative financing, or tapping into down payment assistance programs. The key is making a move when it makes sense for you rather than waiting for a perfect scenario that may never arrive.

Want to take a look at what’s happening with prices in our local market? Whether you're ready to buy now or just exploring your options, having a plan in place can set you up for success.

What’s Happening with Home Prices in Northern Colorado Springs?

If you're thinking about buying a home in 80921, 80908, or 80132, you might be wondering whether it's better to buy now or wait. While national data suggests home prices will continue rising at a steady pace, here’s what’s happening locally:

📊 Home Prices in Northern Colorado Springs

Current Median List Price and Days on Market: $753K, 41 Days

One Year Ago: $777K, 47 Days

Peak in June 2024: $800K

This means home prices have dipped slightly from last summer but are still historically high. With a projected 3% annual increase, waiting could mean paying even more in the future.

Is the Market Favoring Buyers or Sellers?

📦 Current Inventory Level: 2.6 months (unchanged year-over-year)

🏡 Homes Listed in February 2024: 287

🏡 Homes Listed in February 2025: 491 (71% increase)

While inventory has increased significantly, we’re still in a near-balanced market. This means buyers have more choices than before, but sellers aren’t desperate—homes that are priced appropriately are still selling well.

Affordability Challenges & Buyer Trends

💰 Why Are Some Buyers Still on the Sidelines?

High home values & rising mortgage rates are keeping some buyers cautious.

Most buyers in our market put down 20% or more in cash—if not all cash.

Financing incentives exist but aren’t making a huge impact in our area.

With interest rate volatility and economic uncertainty, some buyers are hesitating. However, the risk of waiting is that prices will keep climbing, and borrowing could become even more expensive.

Should You Buy Now or Wait?

Here’s what to keep in mind:

🚫 You can’t time the market. Historically, waiting for the “perfect” time doesn’t work.

Instead, focus on your financial position and long-term vision.

📈 Prices are expected to rise, meaning the longer you wait, the more you might pay.

🔨 Tariffs on Canadian lumber could drive up new construction costs, making existing homes a better deal.

💡 Buy if your finances are solid & homeownership makes sense for you.

Bottom Line

🏡 The best time to buy is when you’re financially ready. If you wait, you may face uncertainty in prices and interest rates. With increasing inventory and a more balanced market, now could be a great time to find the right home before prices rise again.

💬 Thinking about buying? Let’s talk strategy and explore your best options!

📩 Contact Wolff Real Estate Group today!